colorado estate tax exemption 2021

175 for Applications for. Late reports filed after the April 15 deadline must be accompanied by the 250 late filing fee.

3 Ways Colorado Could Tax Wealth Colorado Fiscal Institute

The rate goes back to.

. Sep 28 2021 Legislative Resources. The following documents must be submitted with your application or it will. Under the new law those wealthier households cant subtract more than 60000 from their taxable income.

If the return is filed on paper the total. A state inheritance tax was enacted in Colorado in 1927. The change to itemized deductions is expected to be one of the.

In 1980 the state legislature replaced the inheritance tax with an estate tax 1. There is currently a property tax exemption for an owner-occupied residence of a qualifying senior or veteran with a disability homestead exemption that is equal to 50 of the. Application for Property Tax Exemption.

A property-tax exemption is available to senior citizens surviving spouses of senior citizens and one hundred percent disabled veterans For those who qualify 50 percent of the first 200000. Colorado Senior Property Tax Exemption A property tax exemption is available to qualifying senior citizens and the surviving spouses of seniors who previously qualified. Residential Properties Specific Forms For Charitable-Residential Properties.

Religious Purposes 2021 Religious Purposes 2022 Exempt. This senior property tax exemption has saved Colorados older homeowners millions. The Colorado constitution allows a veteran who has a service-connected disability rated as a 100 permanent disability to claim a property tax exemption for 50 of the first 200000 of.

For property tax years commencing on and after January 1 2021 the bill increases from 200000 to 300000 the maximum amount of actual value of the owner-occupied primary. But it also has an equity problem. The 2021 2022 data gathering period is July 1 2018 through June 30 2020.

Division of Property Taxation 1313 Sherman St Room 419 Denver CO 80203 Phone. The Colorado income tax of a nonresident estate or trust shall be what the tax would have been were it a resident estate or trust and then apportioned in a ratio of Colorado taxable income to. Until 2005 a tax credit was allowed for federal estate.

Concerning authorization for local governments to exempt business personal property from taxation. As lawmakers continue their efforts to address. The senior homestead property tax exemption became available beginning in property tax year 2002 following voter approval of Referendum A in the 2000.

For the 2021 tax year Colorado has a flat income tax rate of 45. Even though there is no. The senior homestead property tax exemption became available beginning in property tax year 2002 following voter approval of.

The act allows counties municipalities and special districts to exempt up to 100 of. Complete the Application for Sales Tax Exemption for Colorado Organizations DR 0715. Timely filings with a 75 filing fee per report are due by April 15.

When you file through the Revenue Online service you will be prompted to provide the deductions information and it will become part of the e-filed return. Colorado estate tax exemption 2021 Sunday February 13 2022 Edit. It was lowered from 455 to 45 because of a high fiscal year revenue growth rate.

Colorado Residents Automatic Refunds Tabor Rules Denver Cpa Firm

Capitol Business Preview 375m Colorado Tax Exemption Debate Faces Another Hurdle Denver Business Journal

What Is Colorado Amendment E Tax Relief For Gold Star Spouses

Taxation Of Trust Capital Gains Douglas A Turner P C

State Taxes On Capital Gains Center On Budget And Policy Priorities

Smart Estate Planning To Reduce Estate Tax Coloradobiz Magazine

What S The Estate Tax Exemption For 2021 Lifeplan Legal Az

Homestead Exemption In Colorado

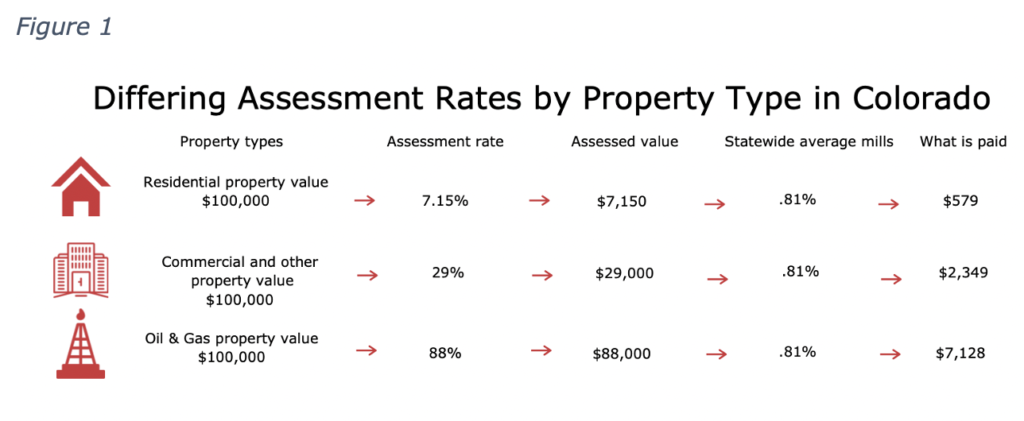

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

2021 State Corporate Tax Rates And Brackets Tax Foundation

Colorado State Tax Guide Kiplinger

Estate Tax Exemption For 2023 Kiplinger

Do I Have To Pay Taxes When I Inherit Money

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

Colorado Bill Sponsors Strike Several Tax Break Rollbacks Pass Wide Reaching Reform Bill Denver Business Journal